By Indeed Editorial Team

The velocity of money is a measurement that tracks how often people spend their money in an economy. If your line of work requires economic knowledge, learning about the velocity of money can help improve your job performance. Researching the subject can be an important step in advancing your career. In this article, we discuss what the velocity of money is, describe its importance within an economy and include the formula for calculating it.

What is the velocity of money?

The velocity of money is an economic metric that measures the rate at which money moves within a market economy. You can do this by calculating the number of times people spend a unit of currency within a set period, tracking how often the money circulates from one person or organization to another. Economists use the velocity of money to determine the rate at which people spend their funds on goods and services. Although it’s not a key economic indicator, like inflation, gross domestic product (GDP) and unemployment rate, the velocity of money can provide insight into a country’s economy.

Related: Cash Flow vs. Profit: Here’s What You Need To Know

Importance of the velocity of money

Some economists consider the velocity of money to be a relevant indicator of an economy’s overall health, and they correlate a higher velocity of money with a more prosperous economy. This concept often correlates with business cycles and is a component of key economic indicators. Because of this, if a country’s inflation and GDP rise, its velocity of money often rises too.

The main argument for this theory is that, when an economy is expanding, people and companies spend more money, which increases its velocity. Alternatively, when an economy slows, people and companies may be less likely to spend as much money, reducing its velocity.

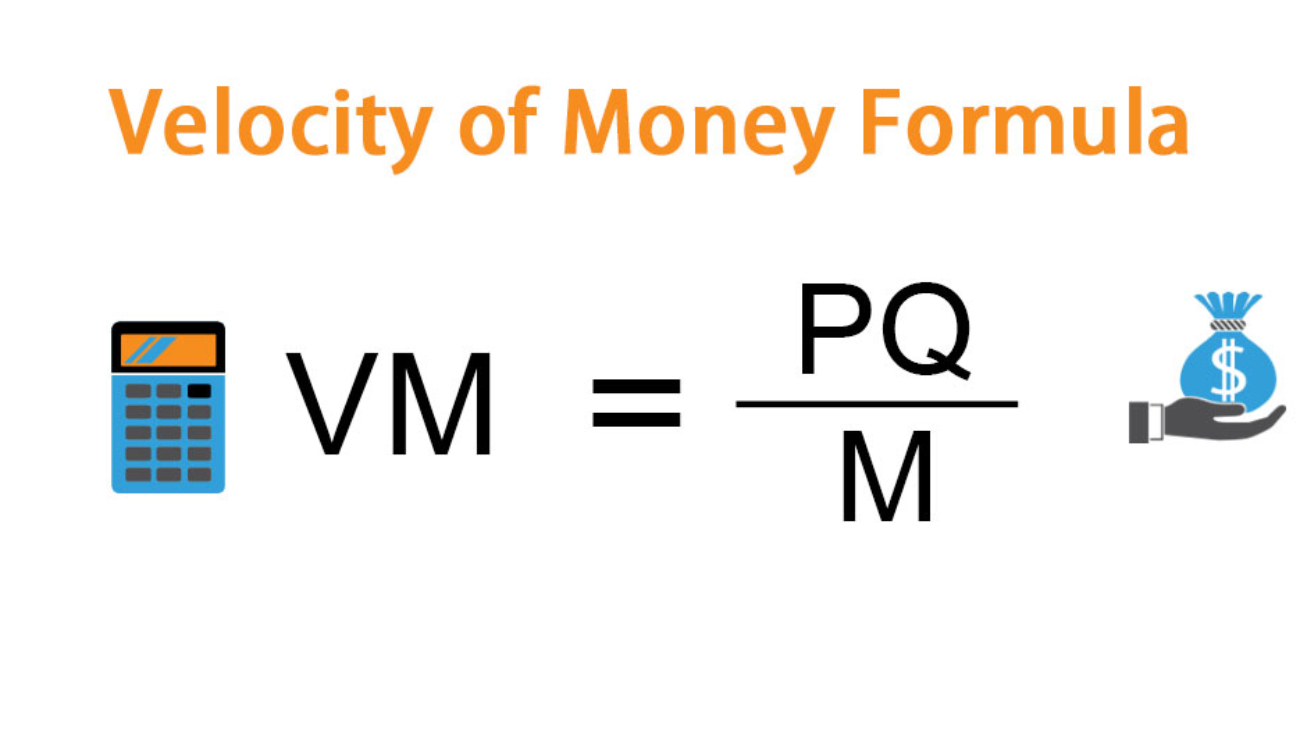

Money velocity formula

There are two elements economists use in the formula to calculate money velocity. This formula and the two components are:

Velocity = GDP / money supply

Nominal gross domestic product

A country’s gross domestic product is a key measure of its overall economic health. It takes into consideration everything the people and organizations within the country’s borders create during a specific period, and it’s the sum of the market value for all final goods and services the country produces. Nominal GDP measures the same output, but it doesn’t adjust the values for inflation. When calculating the velocity of money, you use the nominal GDP because the money supply measure also doesn’t account for inflation.

Money supply

A country’s money supply only includes financial assets people and companies can use to purchase goods and services. Assets like stocks, bonds or home equity don’t count when calculating the money supply because their owners have to sell them before purchasing anything with the money. The money supply also doesn’t include credit card purchases because credit is a form of debt, not money. When you pay back debt, it then enters the money supply. When determining the money supply, you can divide it into two major categories:

- M1: This category includes physical financial assets, such as currency, travelers’ checks and various liquid deposits, including checking account deposits.

- M2: This category includes less tangible liquid financial assets, such as savings accounts, deposit certificates under $100,000 and market funds, except for ones held in IRAs.

Example of calculating the velocity of money

Consider this example of how to calculate the velocity of money:

A closed economy comprises only two people, who are Jill and John. The two perform all transactions within this economy, with Jill selling apples and John selling oranges. Jill has $100, which is the total money supply in the economy, and she uses it to buy $100 worth of oranges from John on one day. The next day, John buys $100 worth of apples from Jill. These are the two transactions that take place in this closed economy within a two-day timeframe, and they occur once per month.

This means the total GDP in a month is $200, and the total GDP in a year is $2,400. Given that they both use the $100 for purchases, you can calculate the velocity of money by dividing the total GDP by the money supply like this:

GDP / money supply = velocity of money

2,400 / 100 = 24

As a result, you can conclude the velocity of money in this closed economy is 24.

Factors that can affect the velocity of money

Several factors can change the velocity of money, including:

Changes in demand for money

The velocity of money changes depending on the supply of money available and how high its demand is. Generally, the velocity of money has an inverse relationship with both of these measures, meaning an increase in the supply or demand of money often results in an increase in the velocity of money. For example, lower demand for money often results in higher spending and an increase in investments, both of which make more money move through in an economy.

Changes in supply of money

Governments can only directly impact the supply of money, not the demand, and they do this by enforcing monetary policy changes. For example, it can try to stimulate an economy by increasing the money supply and lowering long-term interest rates. It does so by buying long-term securities from other banks, leading to an influx of cash to these banks. A result of the sudden excess of cash the banks have at their disposal is they reduce interest rates, which makes it easier for people and organizations to borrow money, which ultimately inserts money into the economy.

Changes in personal wealth

The health of an economy often has a positive relationship with the personal wealth of most citizens in the country. For example, a country in a recession often sees a decline in median family wealth. This can cause a decrease in retirement savings, an increase in unemployment and an increase in homelessness, all of which can lead to an overall reduction in spending. Contrarily, if people have more money to spend, this increases their propensity to consume and the frequency of financial transactions, which both cause an increase in the velocity of money.

Im very pleased to find this page. I wanted to thank you for your time due to this wonderful read!! I definitely savored every bit of it and i also have you bookmarked to check out new information in your blog.